October freight trends show steadiness ahead of holiday season

.jpg)

TQL Monthly Market Update shows truckload market poised for peak cold-chain season

Key points:

The truckload freight market remains stable. While industrial production remains soft, steady retail freight and normal restocking are keeping the market from slipping backward. Volumes remain below 2024 levels, but the gap continues to shrink, and MoM trends are positive.

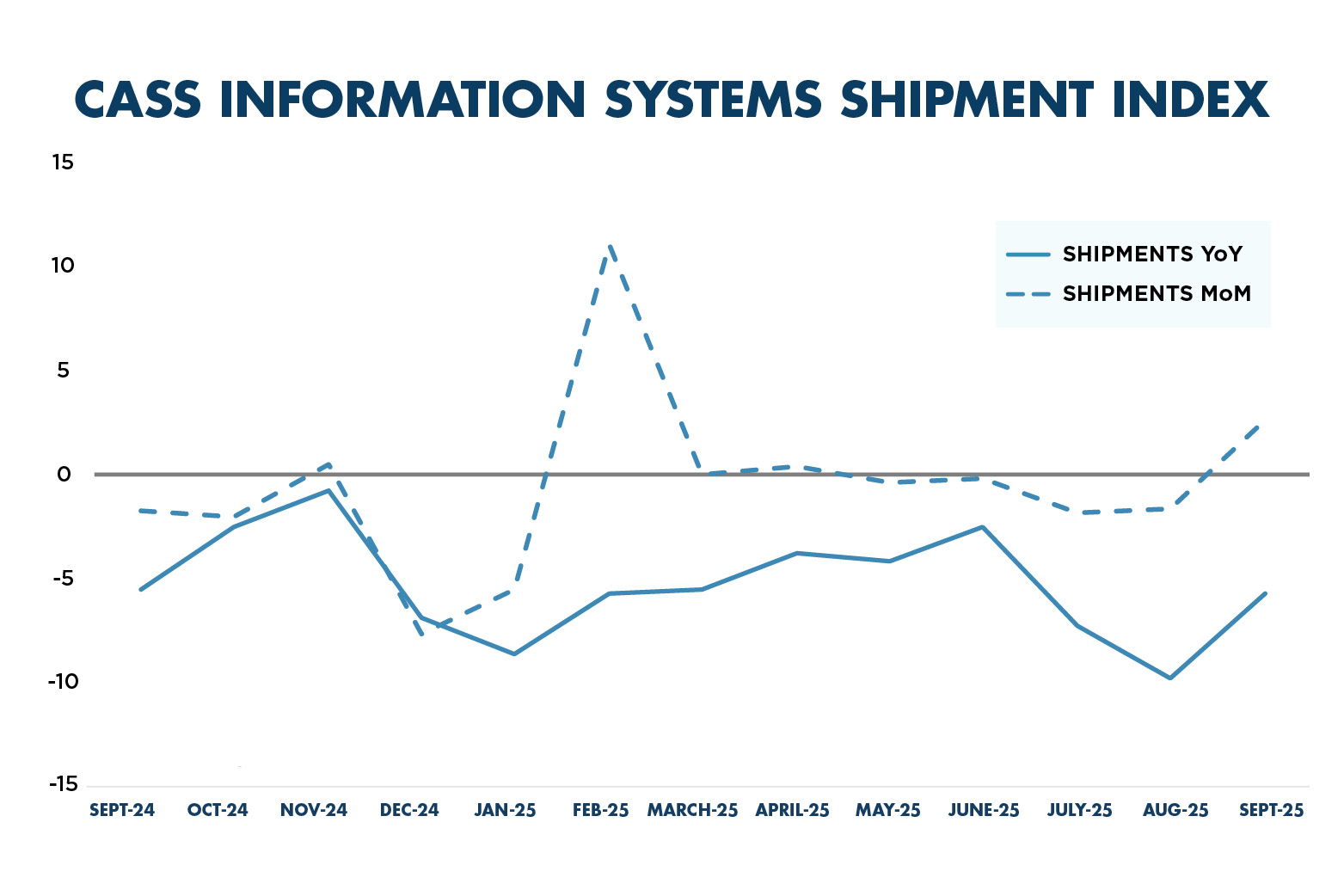

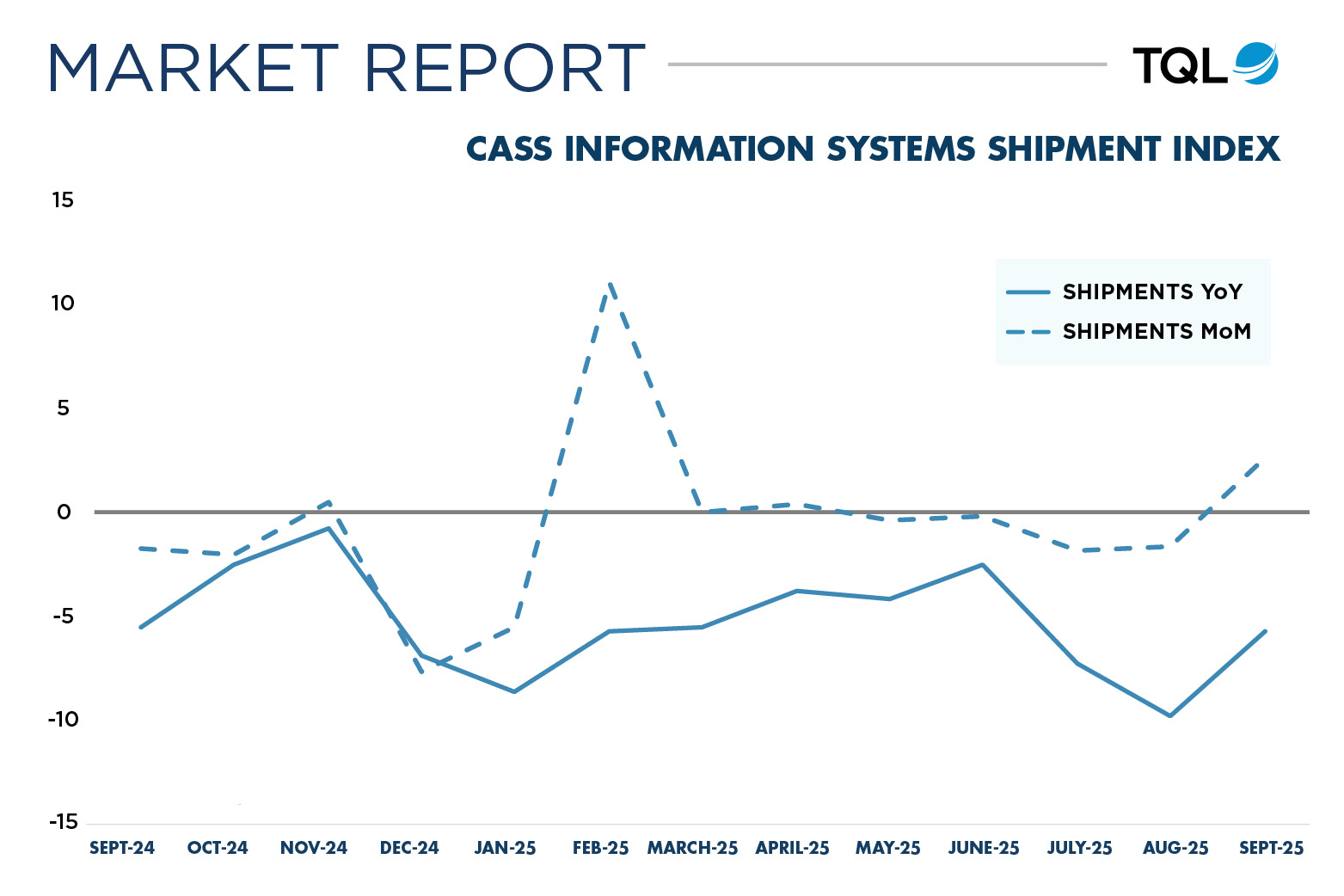

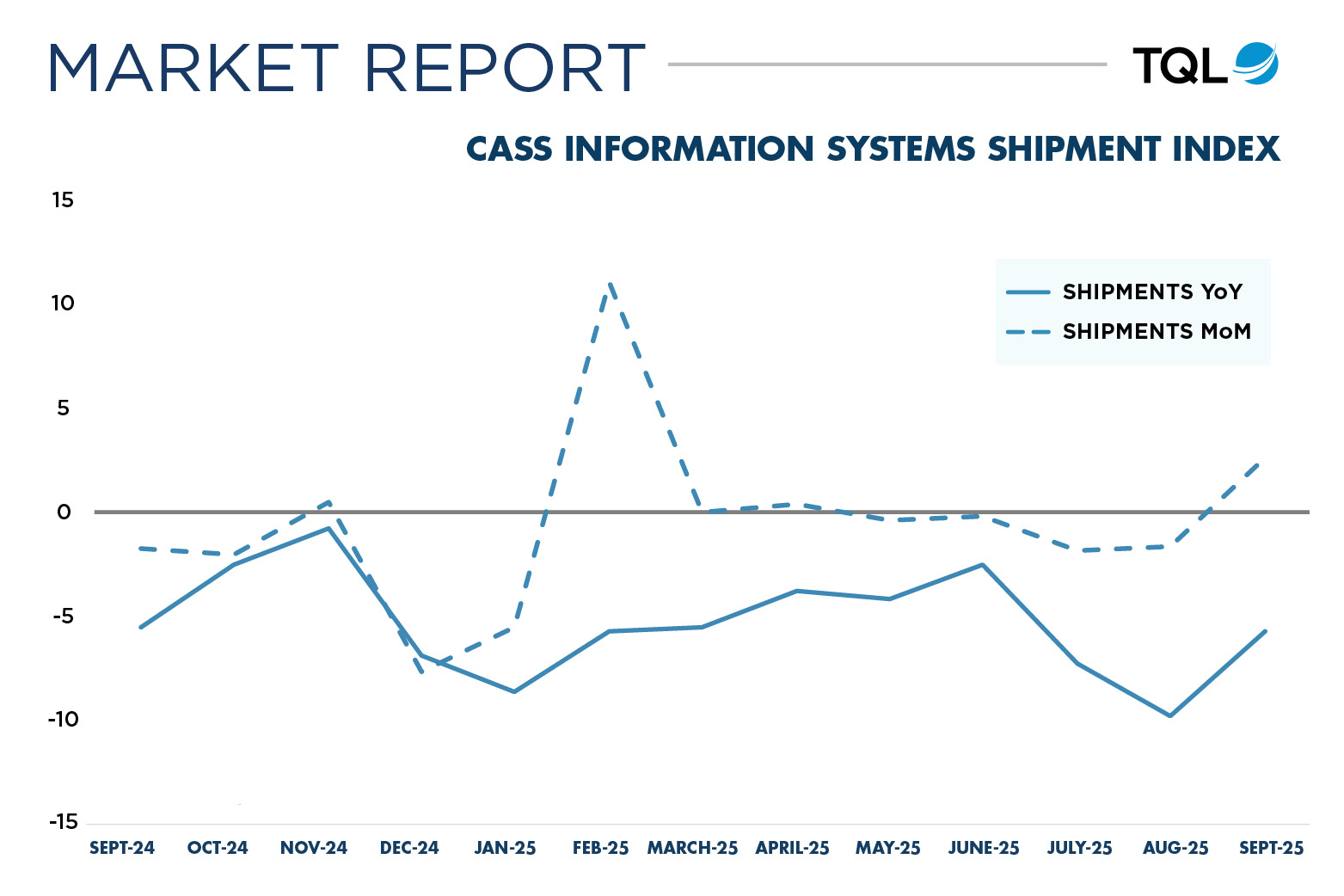

According to Cass Information Systems, September shipments rose 2.5% MoM on a seasonally adjusted basis, while the YoY drop improved to -5.4%. Expenditures increased 5.1% from August and were 2.2% higher than a year ago, reflecting higher fuel costs and modest upward pressure on linehaul spend. In short, activity is improving without overheating, pointing to a market that is active and operationally steady.

Spot trends echo the same equilibrium. Utilization is rising, but rates are flat—a sort of quiet tightening. Carriers are busier, but demand is scheduled and distributed, keeping prices contained. Retail freight continues to anchor the market as inventories flow from regional distribution centers to stores, rather than front-loaded, import-congesting ports.

Altogether, the freight economy remains in a stable equilibrium: demand is level, spending is consistent, and capacity remains elastic. Spot rates are flat because retail replenishment is absorbing available trucks without stress-testing supply. The next meaningful inflection point will likely hinge on consumer spending behavior, the manufacturing sector’s trajectory, and future trade policy as tariff rulings approach in early 2026.

.jpg)

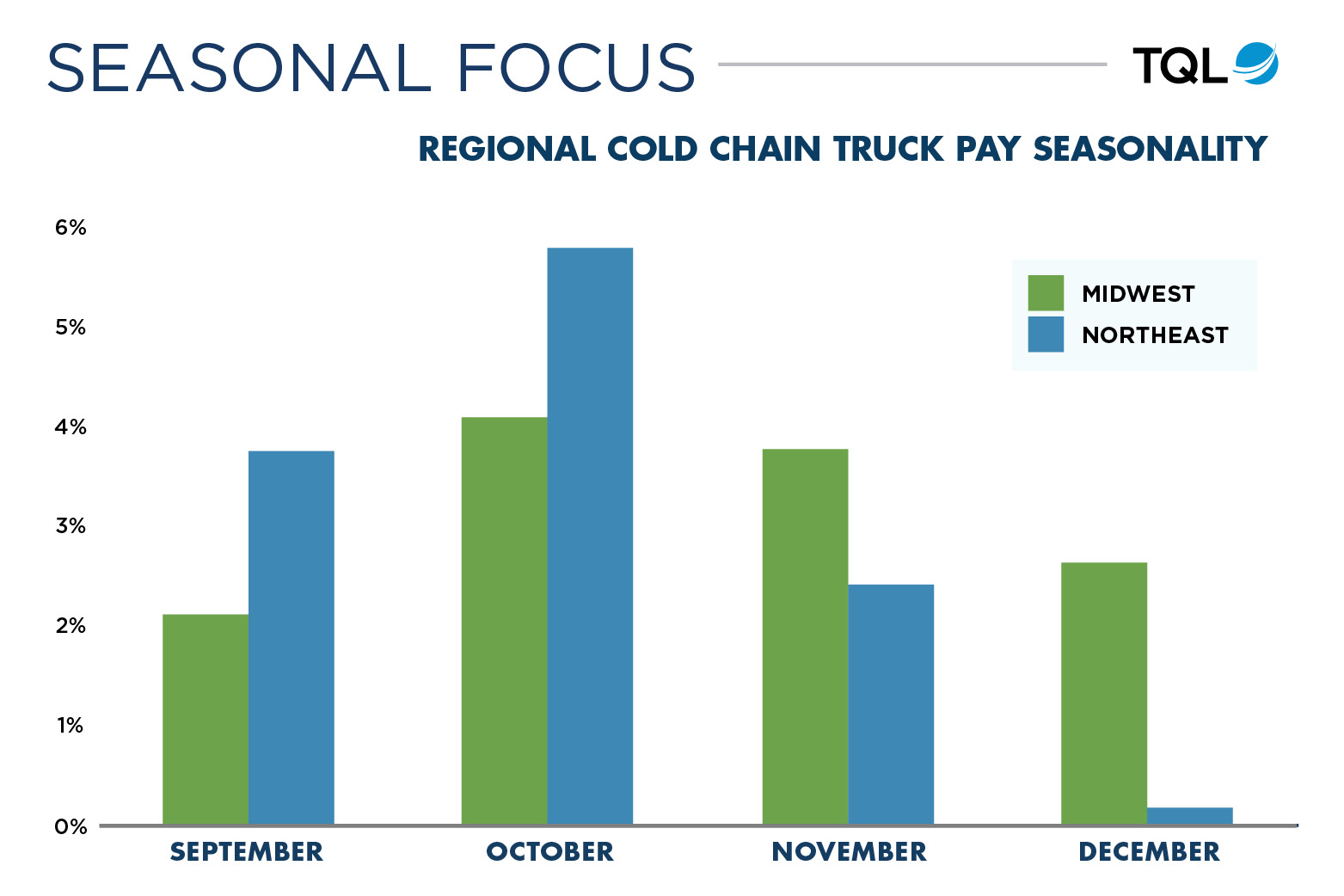

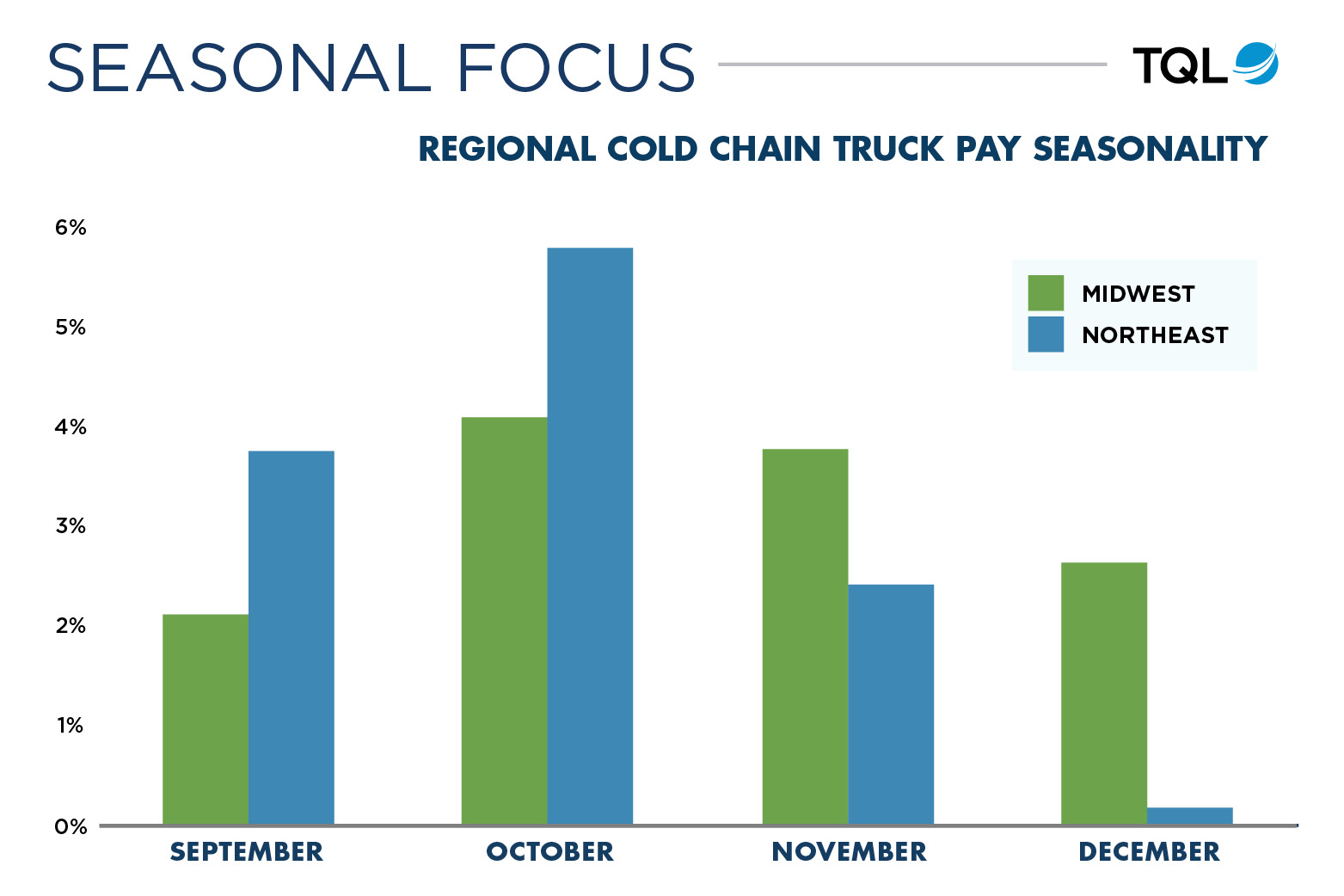

Regional cold chain truck pay seasonality

October marks the transition from the end of produce season to the beginning of peak cold-chain season for refrigerated freight. As agricultural harvests taper off, outbound reefer rates rise steadily throughout the Midwest and Northeast. Food production accelerates for the holidays, and more shippers begin using reefers to protect freight from freezing.

Food and beverage shipments lead the way. By the end of October, grocery chains, restaurants, and distributors begin stocking for Thanksgiving and Christmas, ordering large volumes of turkey, beef, pork, dairy, and beverages. Major meat processing facilities in the Midwest step up production, creating outbound demand to distribution hubs.

At the same time, colder weather introduces a different kind of reefer demand. Many products that are sensitive to freezing—like soft drinks, water, paint, chemicals, and certain food ingredients—move in temperature-controlled trailers set just above freezing. These “protect-from-freeze” loads don’t require cooling, but they do take capacity out of the market. By late October, a large share of reefers in northern states are running in this mode.

Carrier movement adds to the squeeze. Many fleets begin shifting south toward Texas, Florida, and the Southwest to position for the winter produce and import seasons. That migration leaves fewer trucks in northern regions at the exact moment outbound demand is climbing, putting pressure on rates to keep capacity in place.

.jpg)

- Freight demand is steady and rates remain flat as retail flows keep trucks moving.

- Rising cold-chain and “protect-from-freeze” freight are tightening capacity in northern regions.

- The market stays stable with modest month-over-month volume gains and balanced conditions.

The truckload freight market remains stable. While industrial production remains soft, steady retail freight and normal restocking are keeping the market from slipping backward. Volumes remain below 2024 levels, but the gap continues to shrink, and MoM trends are positive.

According to Cass Information Systems, September shipments rose 2.5% MoM on a seasonally adjusted basis, while the YoY drop improved to -5.4%. Expenditures increased 5.1% from August and were 2.2% higher than a year ago, reflecting higher fuel costs and modest upward pressure on linehaul spend. In short, activity is improving without overheating, pointing to a market that is active and operationally steady.

Spot trends echo the same equilibrium. Utilization is rising, but rates are flat—a sort of quiet tightening. Carriers are busier, but demand is scheduled and distributed, keeping prices contained. Retail freight continues to anchor the market as inventories flow from regional distribution centers to stores, rather than front-loaded, import-congesting ports.

Altogether, the freight economy remains in a stable equilibrium: demand is level, spending is consistent, and capacity remains elastic. Spot rates are flat because retail replenishment is absorbing available trucks without stress-testing supply. The next meaningful inflection point will likely hinge on consumer spending behavior, the manufacturing sector’s trajectory, and future trade policy as tariff rulings approach in early 2026.

.jpg)

Regional cold chain truck pay seasonality

October marks the transition from the end of produce season to the beginning of peak cold-chain season for refrigerated freight. As agricultural harvests taper off, outbound reefer rates rise steadily throughout the Midwest and Northeast. Food production accelerates for the holidays, and more shippers begin using reefers to protect freight from freezing.

Food and beverage shipments lead the way. By the end of October, grocery chains, restaurants, and distributors begin stocking for Thanksgiving and Christmas, ordering large volumes of turkey, beef, pork, dairy, and beverages. Major meat processing facilities in the Midwest step up production, creating outbound demand to distribution hubs.

At the same time, colder weather introduces a different kind of reefer demand. Many products that are sensitive to freezing—like soft drinks, water, paint, chemicals, and certain food ingredients—move in temperature-controlled trailers set just above freezing. These “protect-from-freeze” loads don’t require cooling, but they do take capacity out of the market. By late October, a large share of reefers in northern states are running in this mode.

Carrier movement adds to the squeeze. Many fleets begin shifting south toward Texas, Florida, and the Southwest to position for the winter produce and import seasons. That migration leaves fewer trucks in northern regions at the exact moment outbound demand is climbing, putting pressure on rates to keep capacity in place.

.jpg)