November freight market overall remains steady, according to industry sources

TQL Market Report shows overall industry freight market losing momentum, with manufacturing still in contraction

Key points:

- Industry-wide Q3 shipments declined again, reversing the Q2 lift, according to U.S. Bank.

- Manufacturing remains in contraction with uneven demand.

- Holiday timing and cold-chain freight may briefly tighten capacity.

U.S. Bank National Shipments Index dropped 2.9% compared to Q2 2025, reversing the brief Q2 improvement. It contracted 10.7% from a year prior, compared to the third quarter of 2024.

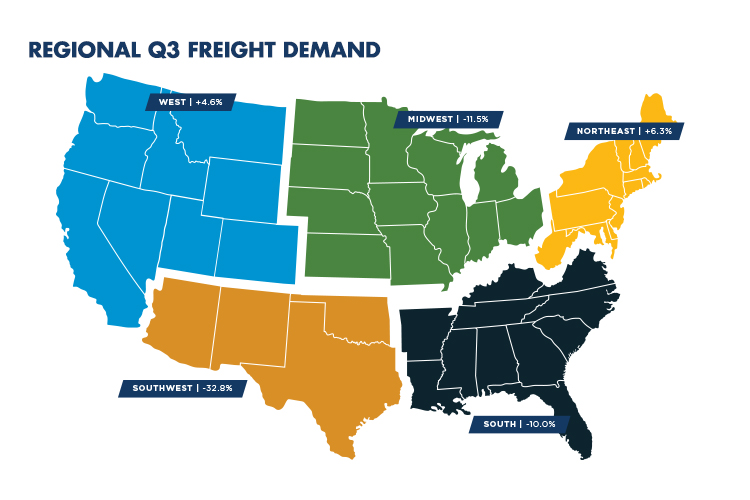

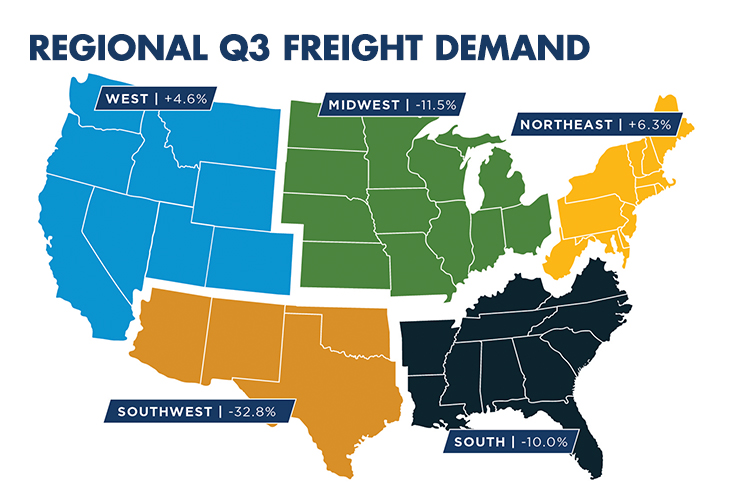

In the third quarter of 2025, shipment performance varied widely across U.S. regions, according to the U.S. Bank Freight Payment Index. While a few regions posted year-over-year growth, others experienced significant declines, reinforcing an uneven freight landscape shaped by import timing, consumer demand and industrial activity.

The U.S. Bank National Shipments Index declined 2.9% quarter-over-quarter and 10.7% year-over-year, indicating that despite isolated regional strength, overall freight demand remains well below year-ago levels and aligned to a muted macro backdrop.

A regional breakdown:

Northeast (+6.3%): The strongest YoY performer, supported by steady consumer-oriented freight and stable replenishment into regional distribution networks.

West (+4.6%): Achieved positive YoY growth, driven by lingering import volumes moving out of warehouses and DCs, reflecting earlier front-loaded inventory rather than new incremental demand.

Midwest (-11.5%): Volumes declined due to continued weakness in manufacturing, particularly in machinery, industrial components and other durable goods segments.

South (-10.0%): Shipment levels contracted as industrial activity remained soft, weighing on outbound freight tied to energy, chemicals, construction inputs and fabricated goods.

Southwest (-32.8%): Recorded the steepest YoY decline, influenced by reduced cross-border activity and policy-driven friction, including new de minimis-related charges and evolving tariff policies that impacted Mexico-to-U.S. trade flows and slowed small-parcel and low-value shipment volume.

Industry focus

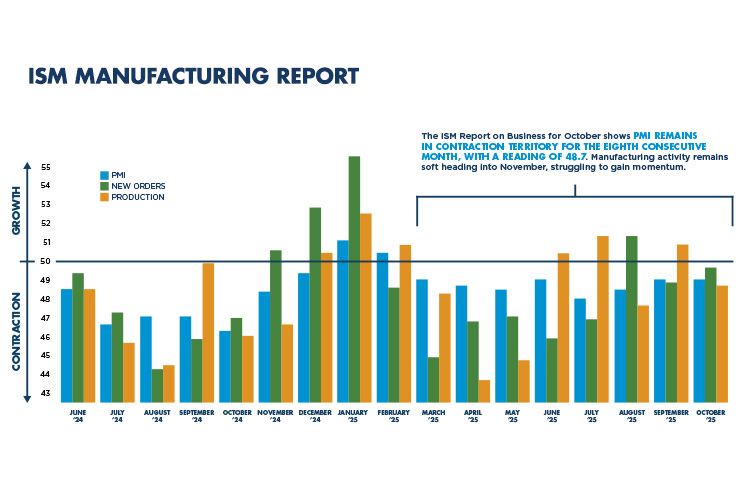

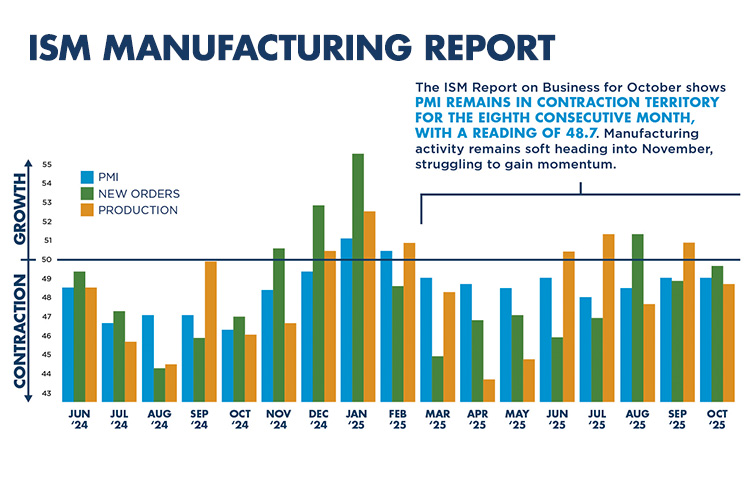

The Institute for Supply Management’s (ISM) Report on Business for October shows the Purchasing Managers’ Index (PMI) remains in contraction territory for the eighth consecutive month, with a reading of 48.7. Manufacturing activity remains soft heading into November, struggling to gain momentum.

The PMI has stayed in the 47-49 range for most of the past year, with only a brief jump above 50 early in 2025 before slipping back. New Orders and Production show the same pattern—short bursts of improvement followed by pullbacks—which signals a manufacturing economy that is steady but still weak. These readings are slightly better than last year, but not strong enough to lift freight demand in a meaningful way.

Across all three ISM measures, the trend is low activity and slow movement. New Orders remain the most uneven, climbing at the end of 2024 and the start of 2025, then cooling again through spring and summer due to tariff policy. Production follows the same stop-and-go behavior as companies try to match output to cautious demand. This mirrors what we’re seeing in truckload: freight volumes are stable, capacity is wide and there’s little pressure on rates.

Looking ahead a few months, we expect this low-equilibrium market to continue. Unless New Orders rise above 50 for several months in a row, manufacturing-linked freight demand will stay flat. Seasonal tightening and regional hot spots will still occur—especially in reefer and cross-border lanes—but the overall market should remain balanced through winter. Trade policy may create short-term shifts, but not enough to change the national trend.

What we’re watching

Thanksgiving week will tighten capacity, but only briefly. Driver time off reduces available trucks for 3-4 days during the holiday week. Rates typically rise the Tuesday and Wednesday before Thanksgiving, but most markets normalize by the following Monday as drivers return.

Count on TQL to keep your freight moving smoothly. Contact your dedicated Logistics Account Executive today, visit TQL.com or call (800) 580-3101.