December retail stock clearance keeps truckloads moving, per industry sources

TQL Market Report shows overall consistent shipping activity during retail inventory sell-off

Key points:

- Industy-wide, retailers are selling through extra inventory, which is keeping trucks busy but predictable.

- Stores aren’t restocking much at year-end because they’re still working through what they already have.

- Truck rates are moving up and down with the season, but there’s no real squeeze on freight capacity.

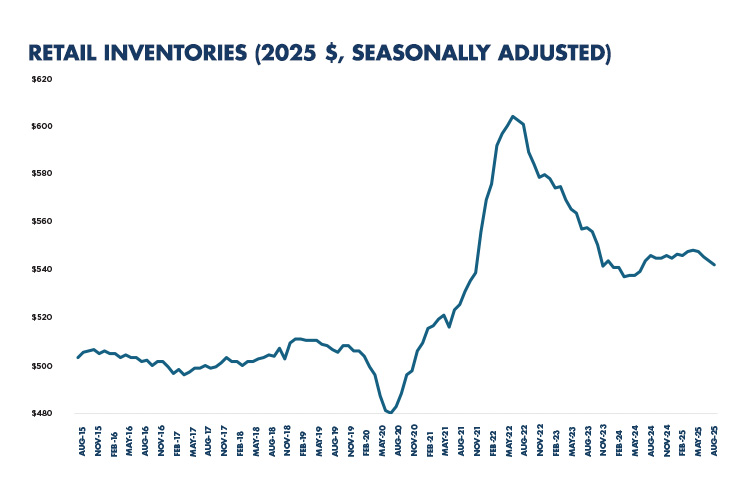

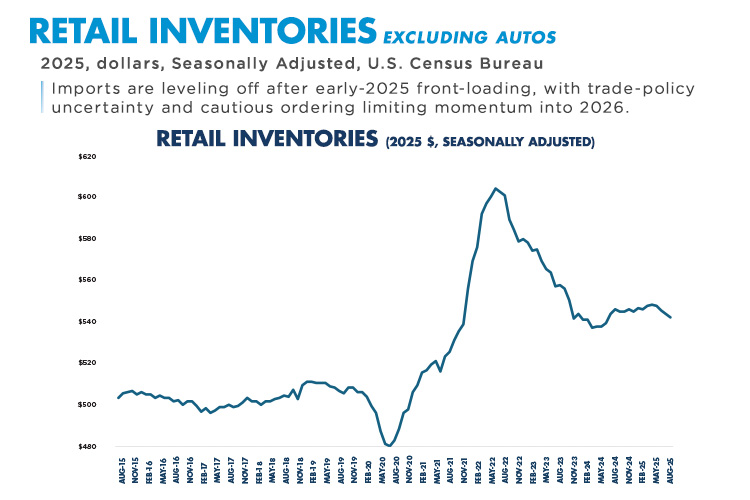

Retailers spent the first half of 2025 front-loading inventory, pulling forward goods ahead of tariff uncertainty and expected cost increases, according to industry sources. That early surge supported freight volumes in the first half of the year but also left retailers with elevated stock levels entering the back half of 2025.

Since summer, inventories have been gradually drawing down, yet they remain well above pre-pandemic norms, reducing the need for additional replenishment.

This inventory position directly shapes the truckload market. With retailers already holding more inventory than current demand requires, the traditional year-end replenishment cycle has not materialized.

Freight tied to retail replenishment has remained steady and predictable, keeping capacity broadly available. While freight rates have moved higher recently, those increases reflect normal seasonal patterns rather than tightening underlying market fundamentals.

The mix of freight volumes reinforces this dynamic. Current activity is dominated by distribution center–to–store restocking and direct-to-consumer flows, not inbound inventory builds. That imbalance is increasingly visible across the supply chain.

The Logistics Managers’ Index recently reported consecutive month-over-month declines in warehouse utilization for the first time in its nine-year history, underscoring the same message: inventory is moving out of the network, but it is not being replaced at the front end.

In practical terms, trucks are moving, but the system is not being refilled—allowing seasonal demand to lift utilization and rates without creating sustained pressure on truckload capacity.

.jpg)

Imports lose momentum heading into 2026

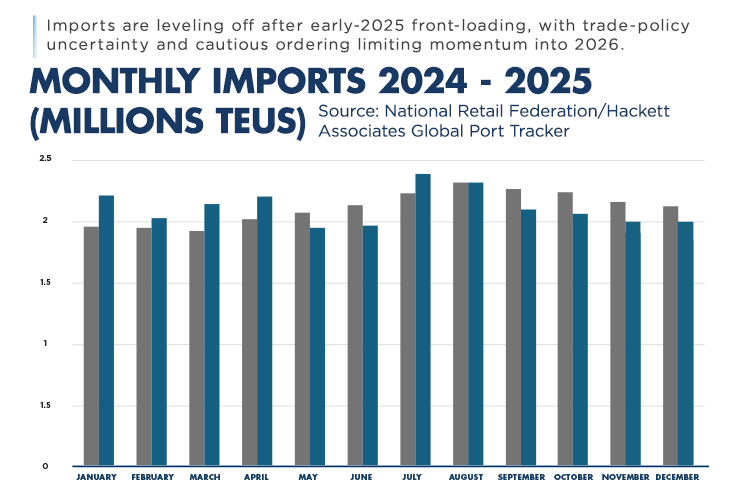

Import trends reinforce the same cautious posture seen in retail inventories.

After peaking earlier in 2025 as retailers front-loaded cargo ahead of potential tariff changes, import volumes failed to reaccelerate at the end of the year. Activity slowed into November and December, signaling that retailers are focused on working down existing stock rather than positioning for a new replenishment cycle.

The National Retail Federation (NRF) Global Port Tracker attributes the softening outlook to trade-policy uncertainty and tariff risk rather than a collapse in consumer demand. While retailers entered the holiday season well stocked, unresolved tariff decisions and shifting trade rules are weighing on forward ordering.

As a result, NRF and Hackett Associates expect import volumes to remain subdued into early 2026, with any month-to-month improvement reflecting normalization after earlier pull-forwards—not the start of sustained growth.

For freight markets, this environment points to stability rather than expansion. Port and drayage activity should remain orderly, supported by steady flows but limited inbound growth.

Inland truckload markets are likely to continue operating in a low-equilibrium state, where seasonal price movement appears in short windows but is not reinforced by inventory rebuilds or freight-generating demand.

.jpg)

We’re watching

We are closely tracking manufacturing conditions through the ISM Report on Business, retail inventory levels, import trends and ongoing changes to trade policy.

Until policy uncertainty clears and freight-generating demand returns, particularly from manufacturing and inventory replenishment, the truckload market is likely to remain neutral, with rate movement driven primarily by seasonal swings rather than structural tightening.

Count on TQL for logistics expertise and freight solutions. Contact your dedicated Logistics Account Executive today or call (800) 580-3101.